Capital One

Manager, Commercial Real Estate Credit Officer

Manager, Commercial Real Estate Credit Officer

Capital One is seeking an Industry Commercial Credit Officer with a background in commercial real estate lending or finance. This candidate will be part of the Credit Risk & Analytics (CR&A) organization, operating in a high-profile environment. The position is primarily responsible for portfolio management activities, and secondarily to provide support to the Senior Credit Officer in risk assessment activities related to new production and modifications and renewal of existing loans, as well as at the portfolio level. The candidate will evaluate annual reviews to assess existing and upcoming risk factors, confirm the appropriateness of recommended risk ratings and evaluate action plans. The candidate will communicate risks outside of normal parameters and discuss recommended courses of action with the Senior Credit Officer. The primary objectives of this position are to ensure that commercial loans within the assigned portfolios are within expected credit parameters, comply with policies and procedures, contain appropriate action plans, and are appropriately risk rated.

On-going Portfolio Management:

- Continuously monitor the credit quality of each transaction in the portfolio, and overall portfolio performance and trends

- Ensure annual reviews are well-documented with accurate and appropriate risk ratings based on a grounded forward-looking view

- Identify deteriorating credits and take appropriate action to mitigate risk; Partner with Special Assets team to transition troubled accounts as needed

- Assess drivers of deteriorating credits, evaluate potential contagion and correlation within portfolio and communicate lessons learned to improve underwriting and structure of new transactions

- Ensure portfolio activities comply with internal policies and procedures

- Participate in periodic reviews of portfolios of vulnerable assets rated watch and monitoring of delinquent loans

- Collaborate with the Business as a Subject Matter Expert on regulatory and/or compliance requirements

- Work with CR&A's portfolio analytics group to develop discrete reporting on portfolio metrics

- Communicate individual risks and general emerging risks to the Senior Credit Officer

- Collaborate with the 1st and 2nd line on ad hoc projects in support of the Credit Officer team

Risk Assessment (within allocated credit authority or in support of the Senior Credit Officer):

- Stay abreast of industry and market trends and potential disruptive and emerging risks

- Identify the key historical and future credit (and non-credit) risks related to a specific transaction

- Develop a well-informed and forward-looking view of the business

- Evaluate assumptions and results of cash flow and valuation analysis under base case and stressed scenarios to determine the reasonableness to support sources of repayment

Manage Credit Approval Process (within allocated credit authority or in support of the Senior Credit Officer):

- Ensure all credit exposures and deal renewals/amendments are approved in accordance with existing policies and procedures, both internal Underwriting Standards and external regulatory guidelines, and are appropriately risk rated

- Review and approve Credit Actions appropriate for the risk profile of the Borrower; ask probing questions when warranted

Basic Qualifications

- Bachelor's degree or military experience

- At least 4 years of experience in commercial real estate lending or commercial real estate finance

Preferred Qualifications

- Bachelor's Degree with a major in finance or business or military experience

- Exposure to credit principles and loan structuring

- Exposure to underwriting, structuring or administering commercial loan transactions

- Working industry knowledge of commercial real estate markets and various property types

- Completed formal credit training or relevant on the job training

At this time, Capital One will not sponsor a new applicant for employment authorization for this position.

The minimum and maximum full-time annual salaries for this role are listed below, by location. Please note that this salary information is solely for candidates hired to perform work within one of these locations, and refers to the amount Capital One is willing to pay at the time of this posting. Salaries for part-time roles will be prorated based upon the agreed upon number of hours to be regularly worked.

Chicago, IL: $144,000 - $164,400 for Manager, Industry Comml Credit Officer

McLean, VA: $158,400 - $180,800 for Manager, Industry Comml Credit Officer

New York, NY: $172,800 - $197,200 for Manager, Industry Comml Credit Officer

Plano, TX: $144,000 - $164,400 for Manager, Industry Comml Credit Officer

Candidates hired to work in other locations will be subject to the pay range associated with that location, and the actual annualized salary amount offered to any candidate at the time of hire will be reflected solely in the candidate's offer letter.

This role is also eligible to earn performance based incentive compensation, which may include cash bonus(es) and/or long term incentives (LTI). Incentives could be discretionary or non discretionary depending on the plan.

Capital One offers a comprehensive, competitive, and inclusive set of health, financial and other benefits that support your total well-being. Learn more at the Capital One Careers website . Eligibility varies based on full or part-time status, exempt or non-exempt status, and management level.

This role is expected to accept applications for a minimum of 5 business days.

No agencies please. Capital One is an equal opportunity employer committed to diversity and inclusion in the workplace. All qualified applicants will receive consideration for employment without regard to sex (including pregnancy, childbirth or related medical conditions), race, color, age, national origin, religion, disability, genetic information, marital status, sexual orientation, gender identity, gender reassignment, citizenship, immigration status, protected veteran status, or any other basis prohibited under applicable federal, state or local law. Capital One promotes a drug-free workplace. Capital One will consider for employment qualified applicants with a criminal history in a manner consistent with the requirements of applicable laws regarding criminal background inquiries, including, to the extent applicable, Article 23-A of the New York Correction Law; San Francisco, California Police Code Article 49, Sections 4901-4920; New York City's Fair Chance Act; Philadelphia's Fair Criminal Records Screening Act; and other applicable federal, state, and local laws and regulations regarding criminal background inquiries.

If you have visited our website in search of information on employment opportunities or to apply for a position, and you require an accommodation, please contact Capital One Recruiting at 1-800-304-9102 or via email at RecruitingAccommodation@capitalone.com . All information you provide will be kept confidential and will be used only to the extent required to provide needed reasonable accommodations.

For technical support or questions about Capital One's recruiting process, please send an email to Careers@capitalone.com

Capital One does not provide, endorse nor guarantee and is not liable for third-party products, services, educational tools or other information available through this site.

Capital One Financial is made up of several different entities. Please note that any position posted in Canada is for Capital One Canada, any position posted in the United Kingdom is for Capital One Europe and any position posted in the Philippines is for Capital One Philippines Service Corp. (COPSSC).

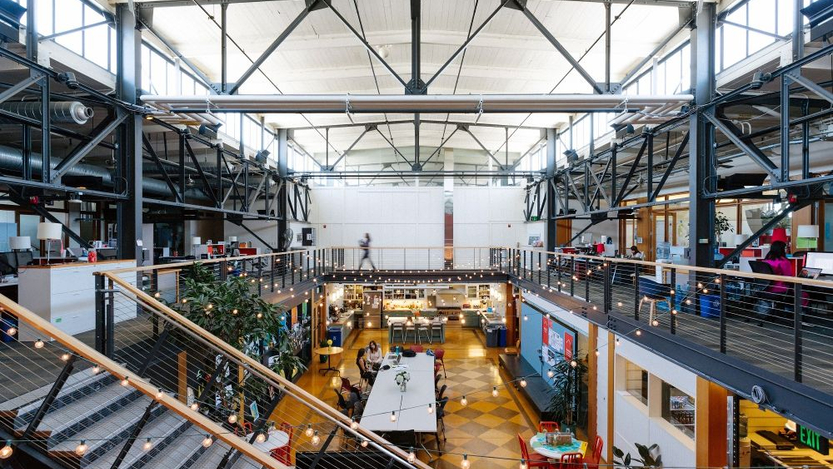

Capital One San Francisco, California, USA Office

Located in the South of Market district, our San Francisco office has everything you need for a flexible work environment. Associates in the office have easy access to public transportation, plenty of restaurants and spacious and comfortable work spaces.

Similar Jobs at Capital One

What you need to know about the San Francisco Tech Scene

Key Facts About San Francisco Tech

- Number of Tech Workers: 365,500; 13.9% of overall workforce (2024 CompTIA survey)

- Major Tech Employers: Google, Apple, Salesforce, Meta

- Key Industries: Artificial intelligence, cloud computing, fintech, consumer technology, software

- Funding Landscape: $50.5 billion in venture capital funding in 2024 (Pitchbook)

- Notable Investors: Sequoia Capital, Andreessen Horowitz, Bessemer Venture Partners, Greylock Partners, Khosla Ventures, Kleiner Perkins

- Research Centers and Universities: Stanford University; University of California, Berkeley; University of San Francisco; Santa Clara University; Ames Research Center; Center for AI Safety; California Institute for Regenerative Medicine