Capital One

Anti-Money Laundering (AML) Supervisor - Enhanced Due Diligence Team

Anti-Money Laundering (AML) Supervisor - Enhanced Due Diligence Team

The Anti-Money Laundering (AML) Investigator II supervises various AML processes, which might include suspicious activity investigations, currency transaction reporting, global sanctions screening, enhanced due diligence or other AML processes. The associate will work closely with AML Process Managers to perform other critical functions. The associate is also responsible for planning and conducting processes related to anti-money laundering and global sanction activities as well as managing the workflow of the AML analysis. The AML Investigator II coaches their team and teaches others about AML processes through training and education.

Additional responsibilities will include:

-Operational Management & Training: Supervise daily workflow and operational metrics of AML Operations team. Daily supervision of a small central unit of Investigators. Assist with training in Regulatory Operations and in the business areas.

-Policy & Procedure Impact: Contribute to internal AML Operations projects related to the modification of policies/procedures. Assess new business acquisitions to determine what work should flow into AML Operations units.

-Quality Assurance: Perform quality assurance on draft Suspicious Activity Reports, sanctions reviews, CTR's, EDD reviews or other AML process.

-Escalation Handling: Handle escalated issues as appropriate for advanced investigation and analysis.

-Industry Knowledge: Assess internal trends, external regulatory and law enforcement environment to make recommendations to understand risk areas and alter or add typologies in certain business areas.

Basic Qualifications:

-High School Diploma, GED or equivalent certification

- At least 2 years of AML (Anti-Money Laundering) experience within financial services

- At least 1 year of people management experience

Preferred Qualifications:

-4 years of AML (Anti-Money Laundering) experience within financial services

-2 years of people management experience

-Certified Anti-Money Laundering Specialist (CAMS) certification, or Certified Protection Professional (CPP) certification, or Certified Fraud Examiner (CFE) certification

At this time, Capital One will not sponsor a new applicant for employment authorization for this position.

The minimum and maximum full-time annual salaries for this role are listed below, by location. Please note that this salary information is solely for candidates hired to perform work within one of these locations, and refers to the amount Capital One is willing to pay at the time of this posting. Salaries for part-time roles will be prorated based upon the agreed upon number of hours to be regularly worked.

Chicago, IL: $86,000 - $98,200 for AML Sr. Investigator II

McLean, VA: $94,600 - $107,900 for AML Sr. Investigator II

Melville, NY: $103,200 - $117,800 for AML Sr. Investigator II

New Orleans, LA: $86,000 - $98,200 for AML Sr. Investigator II

New York, NY: $103,200 - $117,800 for AML Sr. Investigator II

Plano, TX: $86,000 - $98,200 for AML Sr. Investigator II

Richmond, VA: $86,000 - $98,200 for AML Sr. Investigator II

Wilmington, DE: $86,000 - $98,200 for AML Sr. Investigator II

Candidates hired to work in other locations will be subject to the pay range associated with that location, and the actual annualized salary amount offered to any candidate at the time of hire will be reflected solely in the candidate's offer letter.

This role is also eligible to earn performance based incentive compensation, which may include cash bonus(es) and/or long term incentives (LTI). Incentives could be discretionary or non discretionary depending on the plan.

Capital One offers a comprehensive, competitive, and inclusive set of health, financial and other benefits that support your total well-being. Learn more at the Capital One Careers website . Eligibility varies based on full or part-time status, exempt or non-exempt status, and management level.

This role is expected to accept applications for a minimum of 5 business days.

No agencies please. Capital One is an equal opportunity employer committed to diversity and inclusion in the workplace. All qualified applicants will receive consideration for employment without regard to sex (including pregnancy, childbirth or related medical conditions), race, color, age, national origin, religion, disability, genetic information, marital status, sexual orientation, gender identity, gender reassignment, citizenship, immigration status, protected veteran status, or any other basis prohibited under applicable federal, state or local law. Capital One promotes a drug-free workplace. Capital One will consider for employment qualified applicants with a criminal history in a manner consistent with the requirements of applicable laws regarding criminal background inquiries, including, to the extent applicable, Article 23-A of the New York Correction Law; San Francisco, California Police Code Article 49, Sections 4901-4920; New York City's Fair Chance Act; Philadelphia's Fair Criminal Records Screening Act; and other applicable federal, state, and local laws and regulations regarding criminal background inquiries.

If you have visited our website in search of information on employment opportunities or to apply for a position, and you require an accommodation, please contact Capital One Recruiting at 1-800-304-9102 or via email at RecruitingAccommodation@capitalone.com . All information you provide will be kept confidential and will be used only to the extent required to provide needed reasonable accommodations.

For technical support or questions about Capital One's recruiting process, please send an email to Careers@capitalone.com

Capital One does not provide, endorse nor guarantee and is not liable for third-party products, services, educational tools or other information available through this site.

Capital One Financial is made up of several different entities. Please note that any position posted in Canada is for Capital One Canada, any position posted in the United Kingdom is for Capital One Europe and any position posted in the Philippines is for Capital One Philippines Service Corp. (COPSSC).

Top Skills

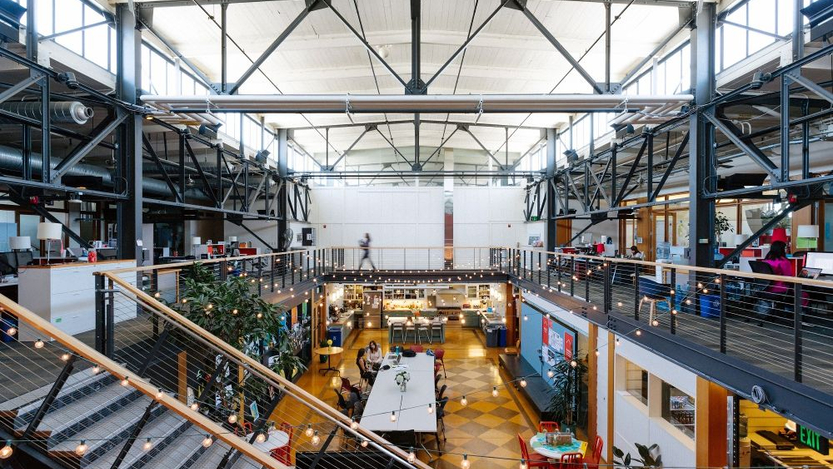

Capital One San Francisco, California, USA Office

.jpg)

Located in the South of Market district, our San Francisco office has everything you need for a flexible work environment. Associates in the office have easy access to public transportation, plenty of restaurants and spacious and comfortable work spaces.

Similar Jobs at Capital One

What you need to know about the San Francisco Tech Scene

Key Facts About San Francisco Tech

- Number of Tech Workers: 365,500; 13.9% of overall workforce (2024 CompTIA survey)

- Major Tech Employers: Google, Apple, Salesforce, Meta

- Key Industries: Artificial intelligence, cloud computing, fintech, consumer technology, software

- Funding Landscape: $50.5 billion in venture capital funding in 2024 (Pitchbook)

- Notable Investors: Sequoia Capital, Andreessen Horowitz, Bessemer Venture Partners, Greylock Partners, Khosla Ventures, Kleiner Perkins

- Research Centers and Universities: Stanford University; University of California, Berkeley; University of San Francisco; Santa Clara University; Ames Research Center; Center for AI Safety; California Institute for Regenerative Medicine

.jpg)