The United States is drowning in debt. An estimated 80 percent of Americans have consumer debt in one form or another, collectively owing about $14 trillion.

However, San Francisco entrepreneur Ilian Georgiev says our difficulty with making the right financial decisions isn’t necessarily a character flaw. In many ways, the human brain simply wasn’t built for figuring out the intricacies of finance.

“We evolved chasing antelopes in the savanna, not running spreadsheets and thinking about APRs and interfaces. That’s why so many people mess up when it comes to their personal finances, because our brain is not built to think that way,” Georgiev told Built In. “We all think that personal finance is harder than it needs to be.”

This is the guiding ideology behind Charlie, a new personal finance app co-founded by Georgiev. The app leans into this human nature and aims to help users channel their spending habits for good by combining aspects of gamification and psychology.

The company announced its official launch on Wednesday, providing a whole suite of tools designed to help users become debt-free faster.

Turning ‘Vices Into Virtues’

Georgiev likens getting out of debt to dieting. Fat-shaming people and putting them on crash diets isn’t likely to yield long-term results. Similarly, completely cutting out “unnecessary” expenses like a daily Starbucks order or a monthly Netflix subscription isn’t going to help someone get out of debt efficiently.

“If you cut out all the things that make you happy, you’re going to fall off the wagon pretty quickly. You need to have positive reinforcement,” Georgiev said. “We don’t say, ‘Hey, you need to change your habits overnight.’ Instead, we take your habits for what they are, we don’t judge, and we try to turn those habits into something positive.”

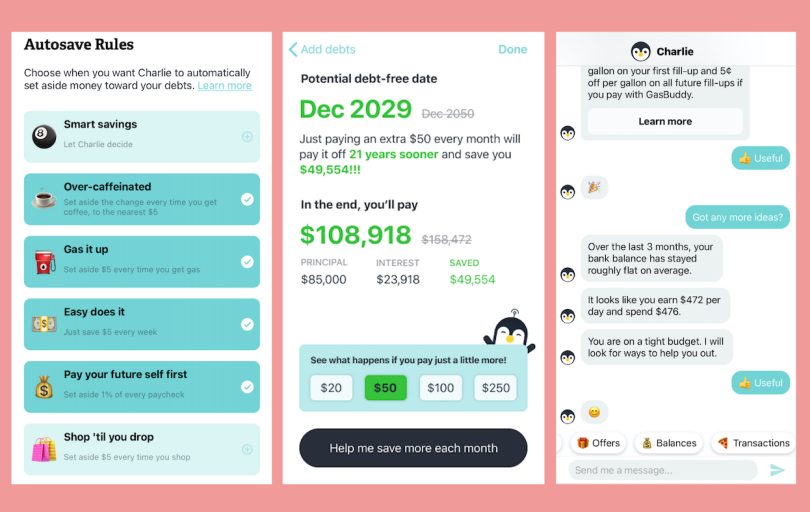

In practice, Charlie does this by having the user input specific information about their debt — the kind of debt, the amount, their interest rate, the minimum payment. The platform then crunches the numbers and gives the user a projected “debt-free date,” which is usually bad news, especially if the user is only doing the minimum payments. But then Charlie shows them a projected date if they paid just $25 more a month. From there, Charlie helps the user find those extra $25.

The main way it does this is through “rules” that the user can choose themselves. For instance, if getting a latte every morning is really important to the user, they can make it so that, every time they spend money at Starbucks, $1 extra goes to the debt fund. Another rule makes it so money is put away every time a contestant on The Bachelor says they’re “here for the right reasons,” or when another million people get the COVID-19 vaccine. The idea, says Georgiev, is to “turn vices into virtues.”

“It’s a win-win,” Georgiev said. “You’re either curbing your bad impulses, or you’re getting out of debt.”

Charlie also analyzes a user’s current spending on a rolling basis so it can help identify areas where spending can be reduced. For example, it can recommend cheaper cell phone plans or a more affordable gym membership. The goal is to educate the user without coming off as judgmental.

‘A Labrador That Is Super Good With Money’

Charlie has been around for about five years, existing only as a chatbot. During that time, Georgiev says the company has been closely monitoring how its users interact with the interface, pinpointing the ways it can most effectively help while, at the same time, offering something never seen before.

For instance, Georgiev recalled when he and the team were testing out the chatbot on its very first user — a woman in Minnesota. They had Charlie ask “Hey, how can I help you?” and the user responded with “Bite me.” Georgiev then decided to have Charlie reply with a self-deprecating joke, which completely turned the conversation around. Within minutes, the woman was going back and forth with Charlie, asking questions about the best ways to save $400 for her daughter’s birthday.

This interaction established Charlie’s entire brand.

“The user is in a very vulnerable place. One of our brand principles is that Charlie is inferior to the user. If you look at most other financial products and brands, they position themselves as the authority figures. It’s a guy in a suit behind a desk looking down.” Georgiev said. “Charlie is a Labrador that is super good with money. He looks up to you, it’s never your fault and there’s nothing you can do to disappoint him.”

Charlie’s design is also a blend of all three of its creators’ backgrounds. Co-founders Robert Luedeman and Ivo Parashkevov both studied psychology in college, and have established careers in the computer science and AI space. Meanwhile Georgiev spent years in the mobile gaming industry.

“The reason why mobile games make so much money is not because, for some reason, that is the only thing that works for mobile devices. It’s because we’ve figured out all these dark arts of nudging people and creating habits,” Georgiev said. “I left mobile gaming and started Charlie because I wanted to use those dark arts for good.”

‘A New Type of Smart Bank’

Georgiev says Charlie is a departure from traditional banks or lenders, which tend to take advantage of a user’s ignorance for their own gain.

Another thing that sets Charlie apart is its user base. Although the company is primarily based out of San Francisco, its services are designed for folks outside the country’s big, metropolitan cities — people who live in what Georgiev refers to as “real America.” The average Charlie user makes about $50,000 a year, and the No. 1 place its users spend money is McDonald’s. The company has users in places like NYC and San Francisco, too, but the app was built for the mom in Minnesota who wants to save up for her daughter’s birthday, not a white-collar worker in Silicon Valley with questions about Bitcoin.

Long term, Georgiev says he hopes Charlie will one day expand into a “new type of smart bank,” one that challenges both the legacy, monolithic banks like Chase and the new challenger banks like Chime.

This latest launch is the first step toward that. Georgiev also says that, in the next three to six months, Charlie will roll out refinancing offerings to its users. Later in the year, the company would like to launch its own Charlie debit card.

“We think the next stage in the evolution is that these experiences will become much more proactive and behavioral. Your bank is not just holding your money, it is actually helping you achieve your own goals, whatever those might be,” Georgiev said. “If we build a proactive, positive behavioral experience, that’s going to deliver better results to the user. And it’s going to allow us to build a better business around it that the traditional players cannot.”