Personal finances can be a sensitive and emotional topic, but two ex-Google and Snapchat employees are trying to change that narrative with the launch of their new app Meemo.

Wisam Dakka and André Madeira met each other 11 years ago working on Google’s search team, and later left to join Snapchat and work closely with Snap’s founder Evan Spiegel. Although the duo knew each other for many years, there was one topic that they often didn’t address: finances.

“People think finances are inherently personal, but I think they can also be social,” Madeira told Built In.

That’s because finances and spending history can paint an accurate picture of your life and what you are interested. It can tell you what type of food people like to eat, what their hobbies are, their social life, how they fill their time and so on. At Google and Snapchat, Dakka and Madeira learned all about ways to leverage people’s interests with technology. And thus the idea for Meemo was born.

Meemo launched out of stealth on Tuesday. The app went through a beta testing program in the Bay Area, but it is now available to the general public. Along with the launch, the company also announced that it secured $10 million in funding. This funding will mostly be put toward employee salaries as the one-year-old company recently grew from nine to about 30 employees.

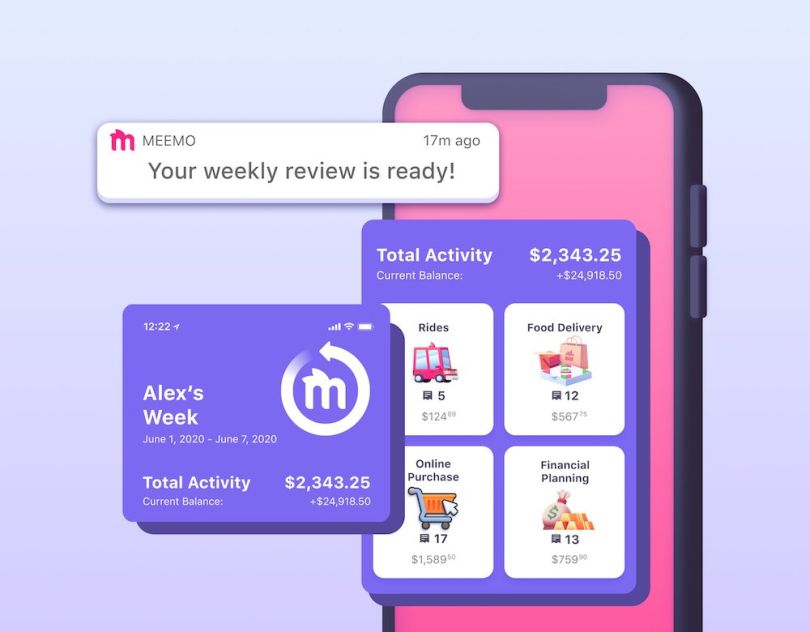

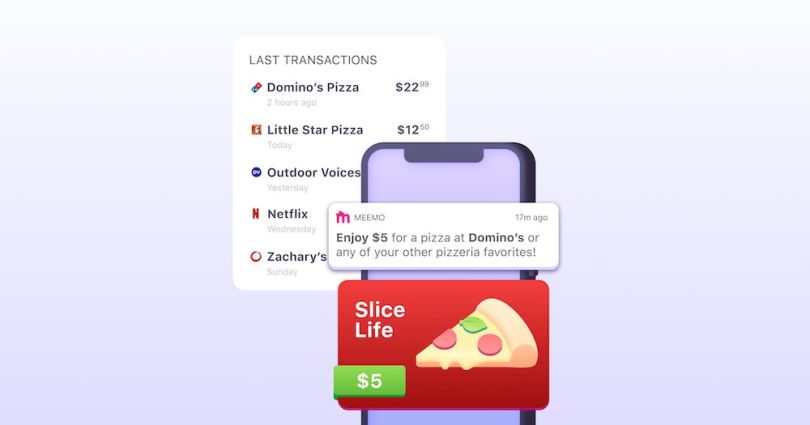

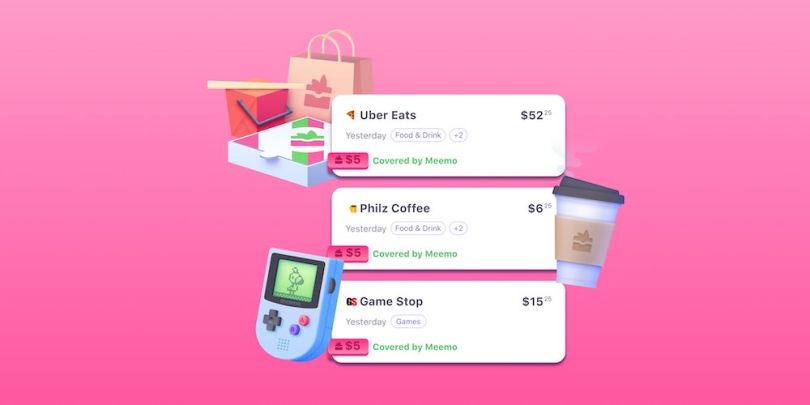

Users who download the Meemo app will be able to connect it to their digital wallet or credit and debit cards. The app then logs spending activity in order to give the user an overview of what’s going on. One of the main draws for users is that the app’s software pulls coupons and discounts from various rewards and cash-back programs, and then applies those discounts to previous transactions. So the app can help you save money on purchases with discounts you may not be aware of.

The app also uses your spending habits to provide insights into how you spend your money. But part of Meemo’s social structure comes from sharing these insights. It can tell you if you spend the most money on sneakers out of all of your friends, or point out the sushi restaurants that other people go to and provide discounts if it notices you spend a lot of money at sushi restaurants. Meemo has also built in several other social features, like the ability to send money to anyone via direct links. The company is also working on building more social features like public profiles.

Meemo tries to be different than other financial management apps by making finances more fun and rewarding. Madeira points out that people sometimes develop negative feelings toward these apps because being told how to manage your finances can be an emotional experience. He says only one in 10 people actually use financial management apps.

“One reason people don’t install financial management apps is because they are in denial about it — they think they don’t need them,” Madeira told Built In. “We don’t want to be your mom and dad and tell you what to do, we want to be your friend.”

As more financial transaction are performed online or through credit cards, there will be more data for Meemo to draw upon. This allows the app to become more personalized for users. But with all this data available, the cofounders said that biggest challenge was being able to present this information in a clean way that is easy for people to understand. Now that they think they’ve done that, they’re ready to release it for the world to use.

The company’s next goal is to grow the Meemo network and acquire more users organically. The company hopes to do this mainly through referrals. The company’s rationale is that, once its users experience the social nature of the app, they’ll want to start using it with their friends.

Meemo is available through the iOS App Store and Google Play.